salt tax limit repeal

The Tax Foundation estimates a full repeal of the SALT deduction limit may reduce federal revenue by 380 billion through 2025 when the provision will sunset. 11 rows As President Bidens tax plans are considered in Congress the future of the 10000 cap for state.

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Eliminating the SALT deduction cap as the 116th Congress recently proposed would reduce federal revenue and make the US.

. This significantly increases the boundary that put a cap on the SALT deduction at 10000 with the Tax Cuts and Jobs Act of 2017. A five-year repeal from 2021. The chief similarities between the SALT deduction limit and the CTC expansion are that both have run up against President Bidens 400000 pledge and encountered non-trivial intraparty head.

This will leave some high-income filers with a higher tax bill. Most people do not qualify to itemize The state and local tax deduction commonly called the SALT deduction is a federal deduction that allows you to deduct the amount you pay in taxes to your state or local governments. The TCJA also repealed the Pease limitation for tax years 2018 through 2025.

SALT Repeal Just Below 1 Million is Still Costly and Regressive. The early repeal of the NOL suspension and business credit limits comes amid strong tax revenues and a 457 billion budget surplus. However property taxes and income taxes not sales taxes are the primary drivers of the SALT deduction.

The SALT deduction is one of the final tax details to be worked out in the House. SALT Cap Repeal Below 500k Still Costly and Regressive Nov 19 2021 Taxes According to press reports the Senate is considering repealing the 10000 cap on the state and local tax SALT deduction for those making 500000 per year or less. If Congress decides to repeal the SALT deduction cap now the AMT and Pease limitation changes become more important.

However the bill stalled in December. 1 day agoFive House Democrats are still fighting for relief on the 10000 limit on the federal deduction for state and local taxes known as SALT. Congressional Democrats are negotiating changes to the 10000 cap on the federal deduction for state and local taxes known as SALT.

Americans who rely on the state and local tax SALT deduction at tax time may be in luck. GOP lawmakers imposed the deduction cap in 2017 with the passage of the Tax Cuts and Jobs Act which slashed the corporate tax rate to 21 and cut individual income taxes for most Americans. And since the Tax Cuts and Jobs Act of 2017 filers who itemize deductions cant claim more than 10000 for SALT increasing levies for.

Meanwhile a growing number of states. In Revenue Ruling 2019-11 PDF posted today on IRSgov the IRS provided four examples illustrating how the long-standing tax benefit rule interacts with the. Nita Lowey D-NY and Rep.

The so-called SALT tax cap imposed a 10000 limit on IRS deductions for state and local taxes like income and capital gains levies and property taxes. House Democrats agreed to a compromise that would raise it to 80000 per year but it was part of the broader Build Back Better Act which. Tax code less progressive.

A two-year SALT cap repeal. The 10000 SALT limit. If the cap were repealed the tax.

House Democrats have proposed increasing the state and local taxes or SALT cap to 72500 from 10000 through 2031. The maximum SALT deduction is 10000 but there was no cap before 2018 You must itemize using Schedule A to claim the SALT deduction. Legislative efforts to repeal the SALT cap are stalled.

Finally the TCJA also put a new limit of a 10000 cap on SALT deductions reducing its value for many taxpayers. Only about 9 percent of households would benefit from repeal of the Tax Cuts and Jobs Acts TCJA 10000 cap on the state and local property tax. House Democrats in November passed a spending package boosting the SALT cap to 80000 from 2021 through 2030 before reinstating the 10000 limit in 2031.

Expansion of SALT Cap Workaround SB 113 expands the SALT cap workaround by allowing the credit for taxes paid by the entity to offset the California tentative minimum tax of 7 percent of taxable income for tax years beginning on. New limits for SALT tax write off Starting in 2021 through 2030 the SALT deduction limit is increased to 80000. Peter King R-NY introduced a bill in the House of Representatives to repeal the 10000 cap on the state and local deduction SALT.

The limit is also important to know because the 2021 standard. Starting with the 2018 tax year the maximum SALT deduction became 10000. Eliminating the SALT.

And the new limit would apply through. There was previously no limit. WASHINGTON The Internal Revenue Service today clarified the tax treatment of state and local tax refunds arising from any year in which the new limit on the state and local tax SALT deduction is in effect.

To avoid cutting taxes for households making over 1 million some politicians have suggested eliminating the State and Local Tax SALT deduction cap for households making below 900000 or 950000 per year. A new bill seeks to repeal the 10000 cap on state and local tax deductions.

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

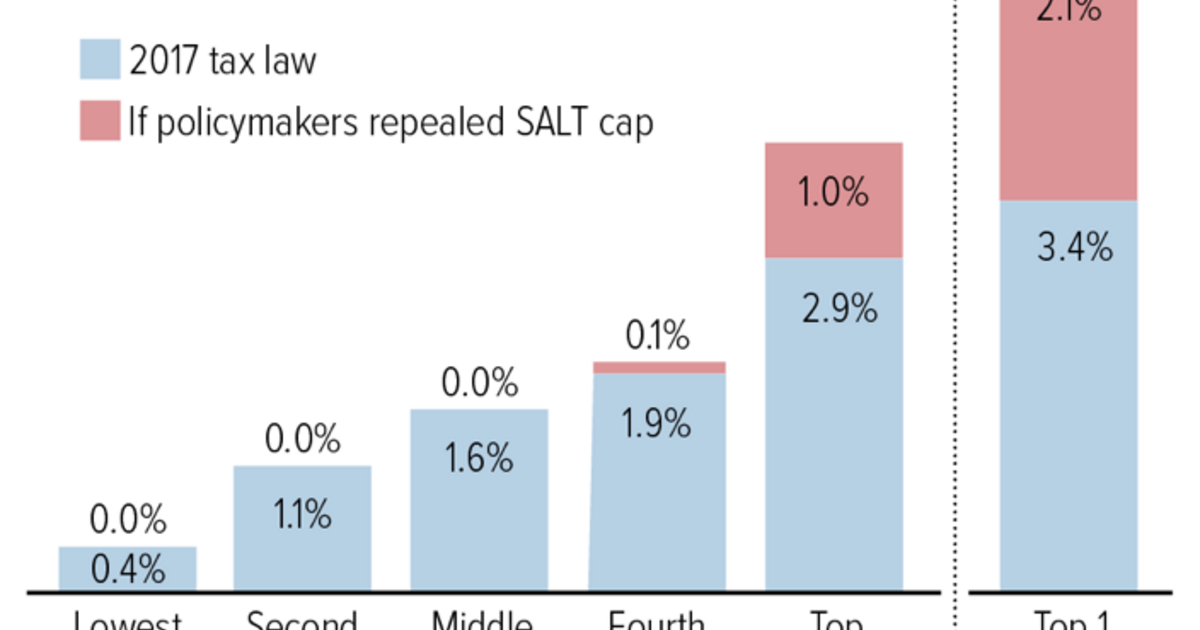

Tpc Impacts Of 2017 Tax Law S Salt Cap And Its Repeal Center On Budget And Policy Priorities

Repealing The Federal Tax Law S Cap On State And Local Tax Salt Deductions Is No Improvement Itep

Tpc Impacts Of 2017 Tax Law S Salt Cap And Its Repeal Center On Budget And Policy Priorities

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Repeal Trump S 1 7 Trillion Tax Cut Then Negotiate Salt Los Angeles Times

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

Salt Deduction Cap Durbin Duckworth Restate Call For Repeal In D C Memo Crain S Chicago Business

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Congressman Mike Garcia Introduces Bill To Repeal State Local Tax Deduction Cap

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

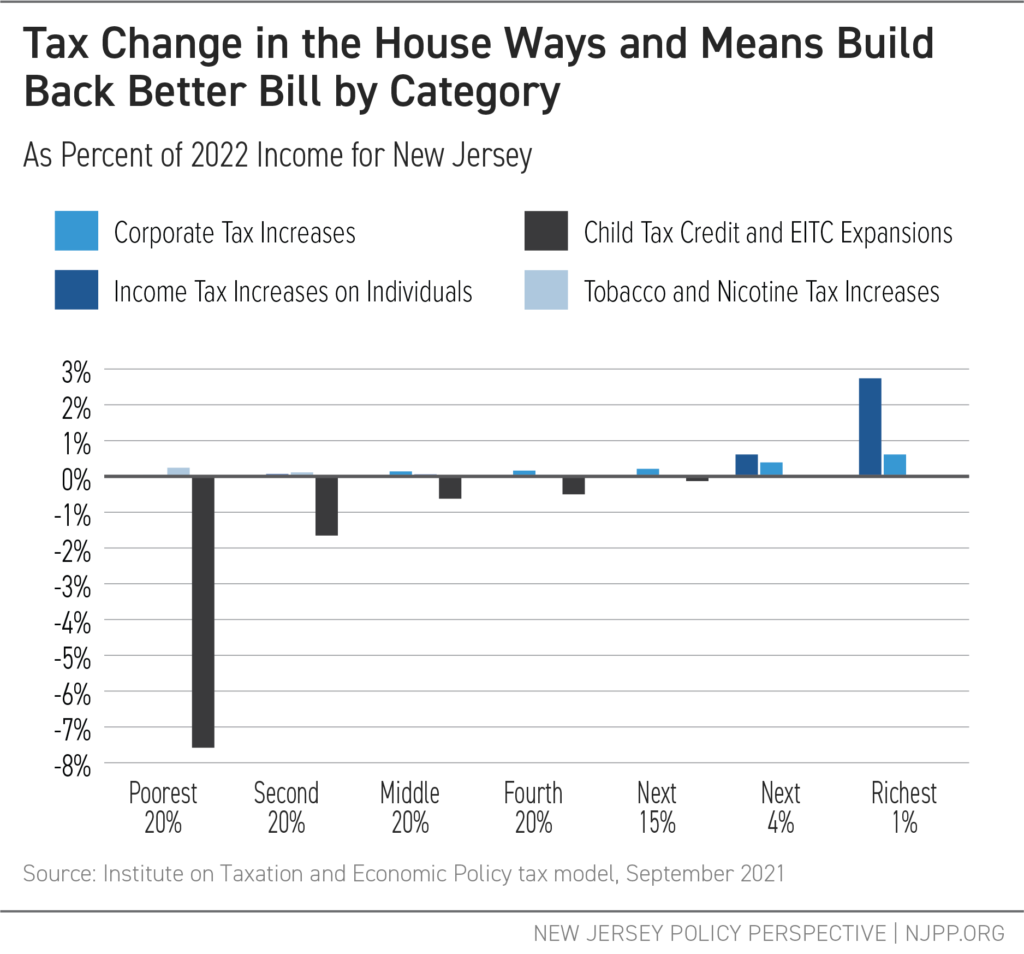

Build Back Better Legislation Makes The Tax Code Fairer But Only If Salt Cap Stays In Place New Jersey Policy Perspective

This Bill Could Give You A 60 000 Tax Deduction

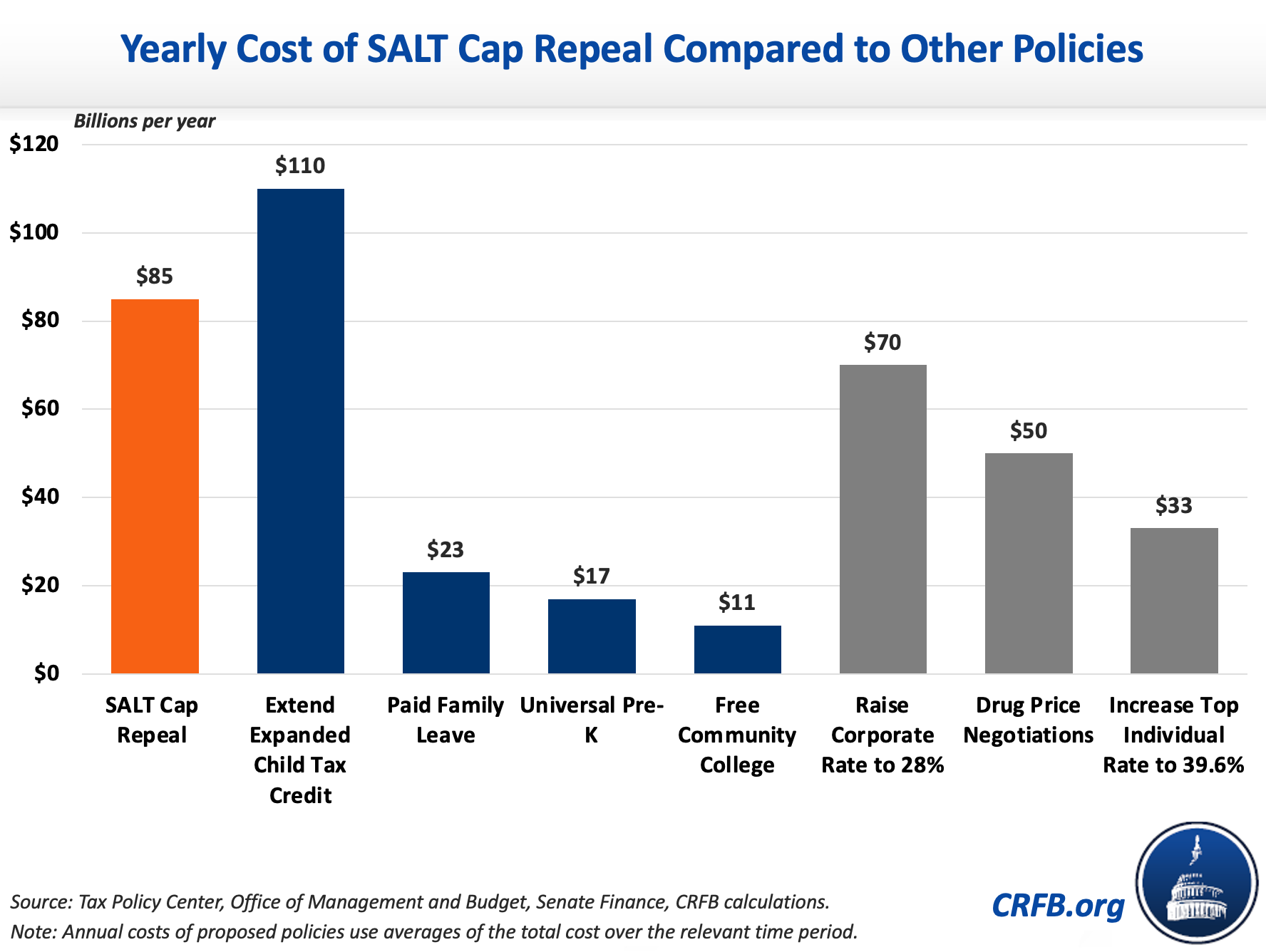

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Repealing The Salt Cap Should Not Be A Top Priority In Reforming 2017 Tax Law Center For American Progress

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

Salt Cap Repeal Would Be A Costly Mistake Committee For A Responsible Federal Budget